SBF: Confirmation Bias Gone Bad

Confirmation bias often causes people to overlook both obvious problems and solutions.

confirmation bias

the fact that people are more likely to accept or notice information if it appears to support what they already believe or expect

Cambridge Dictionary

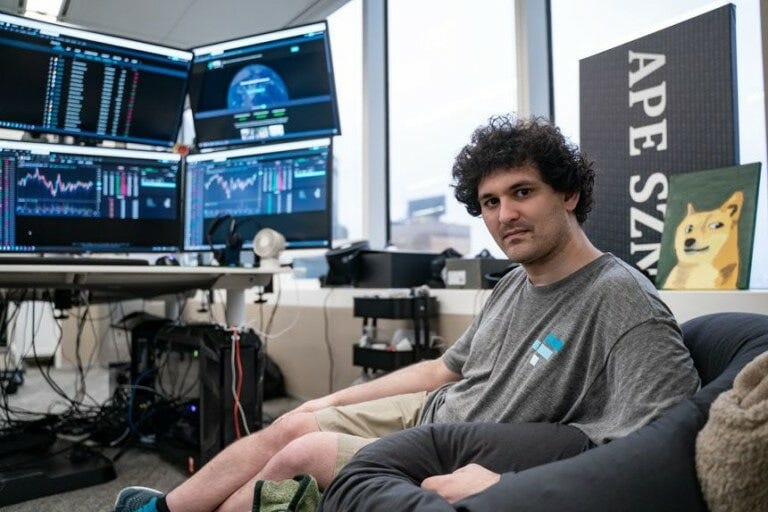

By now, everybody knows about the FTX meltdown. Summarizing, FTX CEO Sam Bankman-Fried “borrowed” money from his crypto exchange to cover losses at his crypto hedge fund, Alameda Research. Rival crypto exchange CEO Changpeng Zhao of Binance started a bank run on SBF’s non-bank, melted it down, and depositors soon learned their digital treasure had been gambled and squandered.

In one of the stupidest articles written about the entire affair, the New York Times inadvertently sums up the problem and misses, badly. “Hey Silicon Valey, Maybe It’s Time to Dress Up, Not Down” wrote apparent fashionista Vanessa Friedman.

…Mr. Bankman-Fried has cast the whole look in a different light. His sloppy dress seems less a reflection of a higher calling or of a decision to devote his own finances to “effective altruism,” than a red flag about a sloppy approach to other people’s money. A clue that someone who doesn’t care about showering or style is maybe someone who doesn’t care about audits and the co-mingling of funds.

Let’s unpack that visually with some well-dressed “someone’s” who, by the NYT’s reasoning, must care about audits and protecting other people’s money.

There’s Elizabeth Holmes who will soon be doing a literal version of Orange is the New Black for about 11 years. A one-off aberration of somebody dressed right gone wrong? No.

Meet Anna Sorkin, Delvey, or whatever she’s calling herself this week looks smashing even sporting her ankle bracelet. Do not loan this woman money or go on a trip with her.

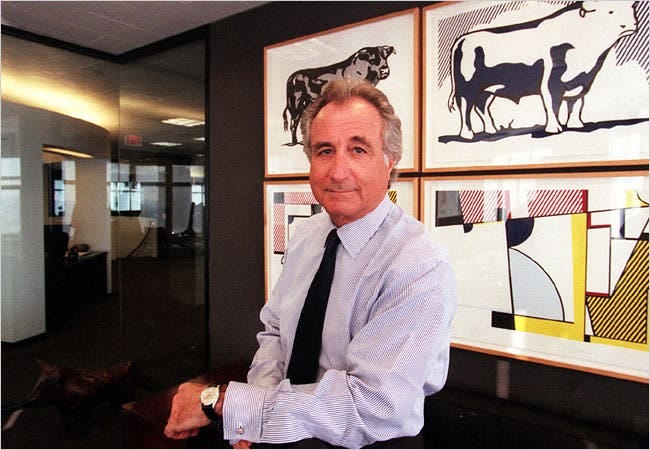

Bernie Madoff’s looking sharp. I once did a data project with a bankruptcy lawyer in South Florida who said the Madoff victims were the saddest: retirees who thought they had generational wealth only to find they couldn’t afford groceries. But at least Bernie looked great.

Lest this list of well-dressed scam artists go on forever, which it would if I wanted to keep copying and pasting, we’ll just cut to Charles Ponzi who, like his many later disciples, exhibited great taste while ripping people off.

The term con man (updated to the more egalitarian con person, I suppose), comes from the word “confidence” - somebody who creates a false sense of confidence. One way to do that is clothing, especially well-tailored clothing, exactly like the New York Times advocates. Fine threads means nothing besides the scammer has good taste in clothes (that you, the mark, will be paying for - thank you).

Doubling down on being wrong, the NYT’s writes “…of course, Mark Zuckerberg’s Adidas flip-flops, hoodies and gray T-shirts, which gave rise to the current tech uniform of choice.” Which is entirely wrong. About a decade before Zuck’s parents did the deed that conceived him, venture capitalist Arthur Rock described Steve Jobs as an unkempt hippie that didn’t wear shoes. Investor Don Valentine asked investor Mike Markkula “why did you send me this renegade from the human race?” also regarding Jobs.

Alan Kay and the Xerox PARC workers dressed better than SBF while they were inventing the internet and modern computer back in the early 1970s but they still would’ve been perceived as schlubs by the receptionists at Goldman Sachs.

More than anything, the NYT misses that what makes the magic come from Silicon Valley is the value the technology creates, not the look of the people who create it. There’s a hint of “screw you” to the money people with the comfy clothes, a reminder by the techies of the valley to the suits about who produces the milk.

In past years some benefits have arguably gone overboard, with techies describing working very few hours for enormous pay and a carload of takeout meals. That will self correct but probably not to the extent many believe: we’re as likely to see silicon valley software engineers in tails as we are in the food stained ties some wore in years gone by. And nobody’s the worse off for it.

People might argue that SBF and his braniac co-CEO brainiac (and sometimes girlfriend) Caroline Ellison pushed dressing down to the extreme except there’s no evidence his t-shirts helped him at all. Rather, investors liked their pedidegrees: his physics major and math minor from MIT and her bachelors in math from Stanford. Both have professor parents. SBF’s are Stanford law professors and Caroline’s are MIT economists making investor confidence in them easier but their digital Bonnie & Clyde adventure harder to understand.

But Mr. Gellasch said some of the “lies were so outlandish,” it’s hard to understand why so many venture capital firms kept giving him money and believing in Mr. Bankman-Fried.

SBF and his entorouge had the right background to convince (there’s that prefix again) people who, like marks from ages ago, were blinded by greed. This had nothing to do with their clothes but a lot to do with a willingness to overlook an absence of genuine value in exchange for a promise of money.

The original reason Silicon Valley dresses down was to signal the trappings of money simply don’t appeal, that they’re after a higher ideal. Rather than blaming their wardrobe selection, or even their ethics, maybe people should blame themselves for believing in what many have been labeling an obvious Ponzi scheme for years.

The New York Times have made it an editorial strategy to loft these anodyne hot takes in some attempt to appear "give all points of view." It is really sad.